Does the hometown of American companies matter?

We have discussed before that country classification is not as easy as you think. This is especially true for companies with multinational operations.

Index providers often combine a combination of country of incorporation, headquarters and primary listing country to determine a company’s “home country.” If this isn’t clear already, determining factors include the location of employees, management, assets, and revenue.

Today we prove that even within In the United States, company location factors can vary significantly. Specifically, we show that the location of the headquarters (HQ) and the location of the company’s domicile vary significantly, even when both are in the same location. within USA.

U.S. companies are registered all over the country

For example, Figure 1 shows the headquarters locations of nearly 3,000 companies in the Nasdaq U.S. Benchmark™ (NQUSB™) Index at the end of 2023.

We also use circle size to show company size (floating market capitalization). Dark blue circles show the largest companies (weighting over 50 basis points).

We see some of the largest companies concentrated in California, Washington, New Jersey, New York, and Texas—although other states are also home to large U.S. companies.

Chart 1: Location of company headquarters NASDAQ US BenchmarkTM

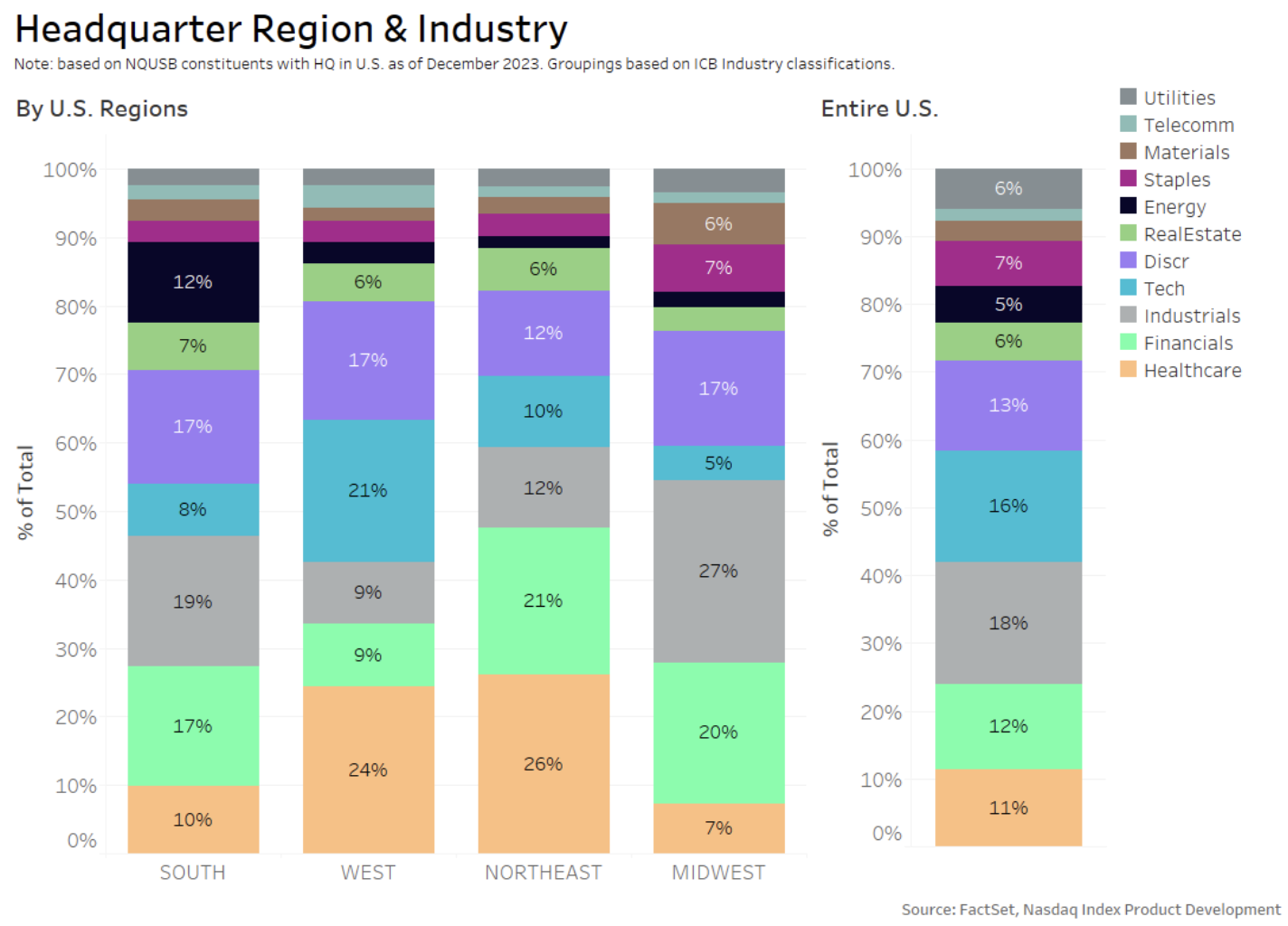

Some regions are more focused on different industries

Using the same data, but not grouped by region, we found that some regions are more focused on a certain area than others. For example:

- More Western tech companies (e.g. AAPL, MSFT, NVDA, GOOG/L META).

- There are more industrial companies in the Midwest (e.g. UNP, GE, DE, SHW).

- Financial industries in the Northeast (e.g., JPM, SPGI, GS, MS, BLK, C) and the Midwest (BRK, PGR, CME).

- Healthcare in the Northeast (e.g. JNJ, MRK, TMO, PFE) and West (e.g. AMGN, ISRG, GILD).

Figure 2: Distribution of enterprises by industry and region

The chart above uses the ICB industry classification of nearly 3,000 companies on the Nasdaq US benchmark. Interestingly, the number of companies in the South, West and Northeast is almost even.

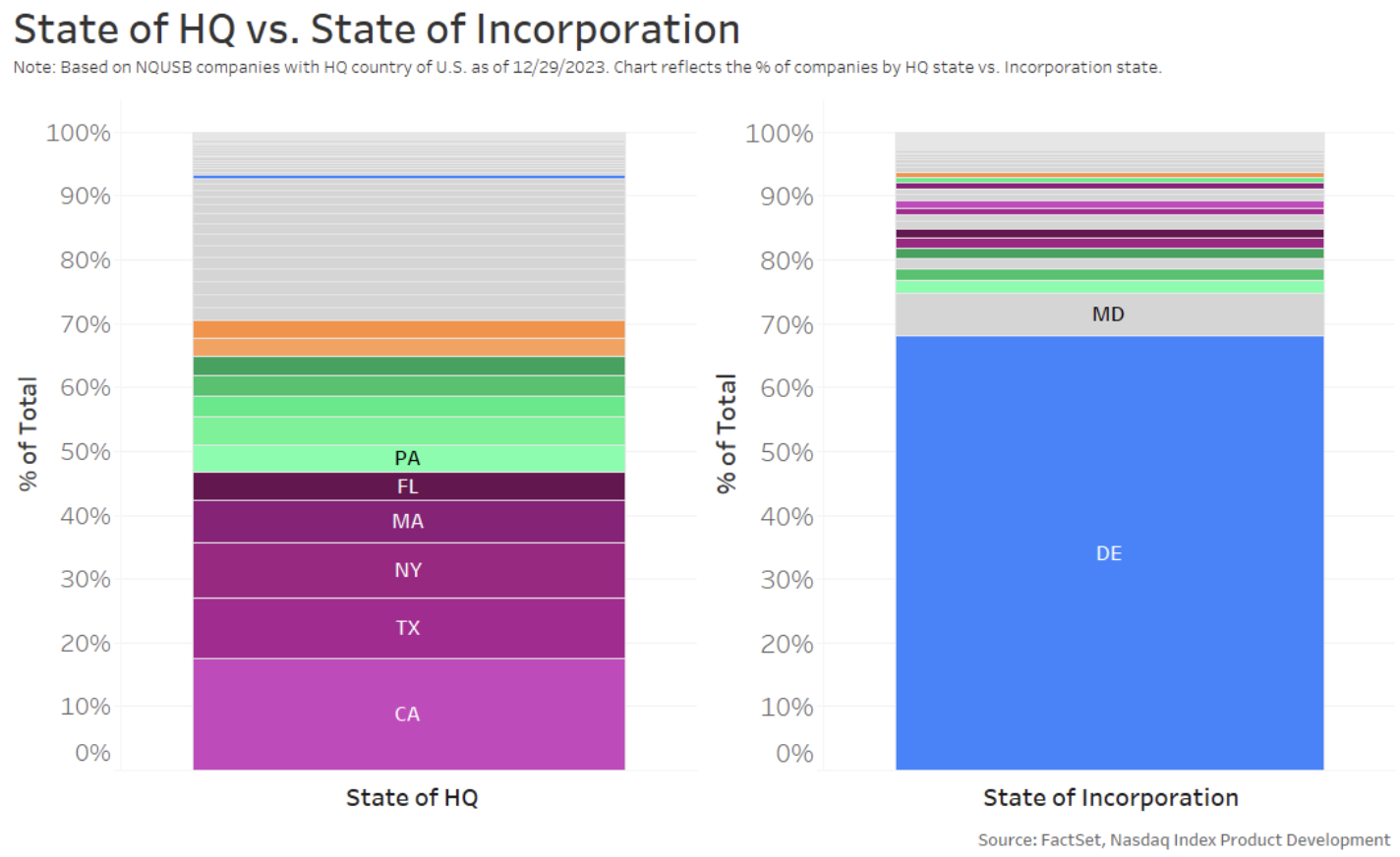

Company data is disparate and centralized

Interestingly, when we look at mergers, the data tells a very different (and focused) story. Approximately 65% of companies are incorporated in Delaware, a state known for its business-friendly tax, legal and regulatory policies and its well-established corporate court system (Figure 3). Despite being headquartered further afield, 77% of Western companies are incorporated in Delaware, a much higher percentage.

Figure 3: The state where the company is headquartered and the state where the company is registered

why this is important

Once again, we see that even for a company that is clearly “U.S.”, incorporation may not be the best guide to where the company’s “home” really is.

These results also have important implications for how “native bias” operates. Investors view stocks like AAPL and MSFT as “American” as JNJ, JPM and XOM – even though some stocks are thousands of miles apart.

But it helps make the U.S. a larger single market, with more diverse companies, all able to trade and settle at the same time. This in turn helps the U.S. market ecosystem support deeper liquidity and cheaper trading.